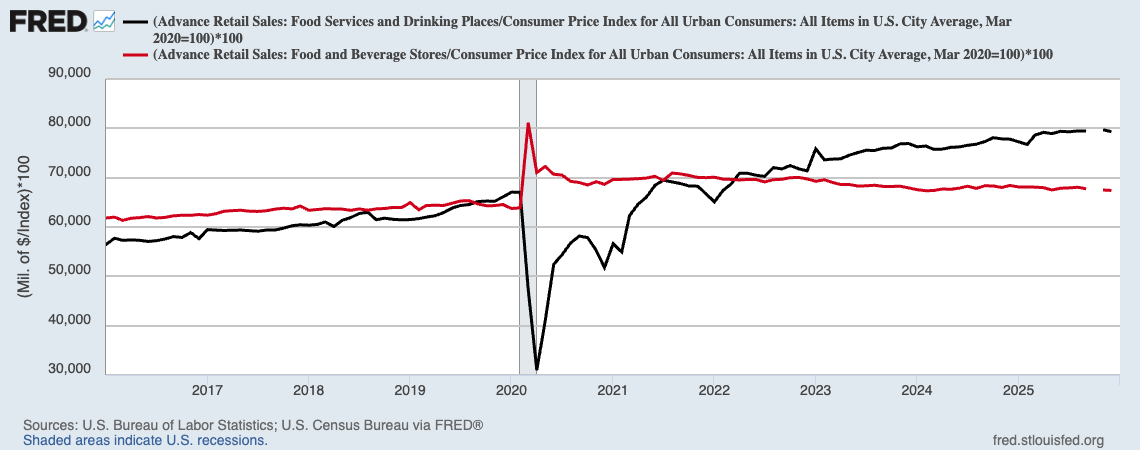

Question of the Day: Groceries or Restaurants: Where are Americans spending more money?

Americans make food spending decisions every day — but where does most of that money actually go?

Answer: Restaurants

Questions:

- What stood out to you from the graph?

- How does where you live or how much you earn affect this split?

- Predict how food spending might change in the next five years. What factors could influence these changes?

Click here for the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the numbers (McKinsey)

"Over the last two years, US food inflation has diverged. Restaurant and takeout costs climbed faster than grocery prices, which started to level off after sharp increases in 2022. According to the US Consumer Price Index, “food away from home” rose about 6 percent from January 2024 to September 2025, driven by rising labor, rent, and ingredient costs. Meanwhile, “food at home” rose only around 3 percent over the same period. If the gap widens, consumers may perceive there to be less value in dining out relative to the cost of doing so—putting added pressure on restaurants that are already grappling with higher costs and shifting demand."

About the Author

Kathryn Dawson

Kathryn (she/her) is excited to join the NGPF team after 9 years of experience in education as a mentor, tutor, and special education teacher. She is a graduate of Cornell University with a degree in policy analysis and management and has a master's degree in education from Brooklyn College. Kathryn is looking forward to bringing her passion for accessibility and educational justice into curriculum design at NGPF. During her free time, Kathryn loves embarking on cooking projects, walking around her Seattle neighborhood with her dog, or lounging in a hammock with a book.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS