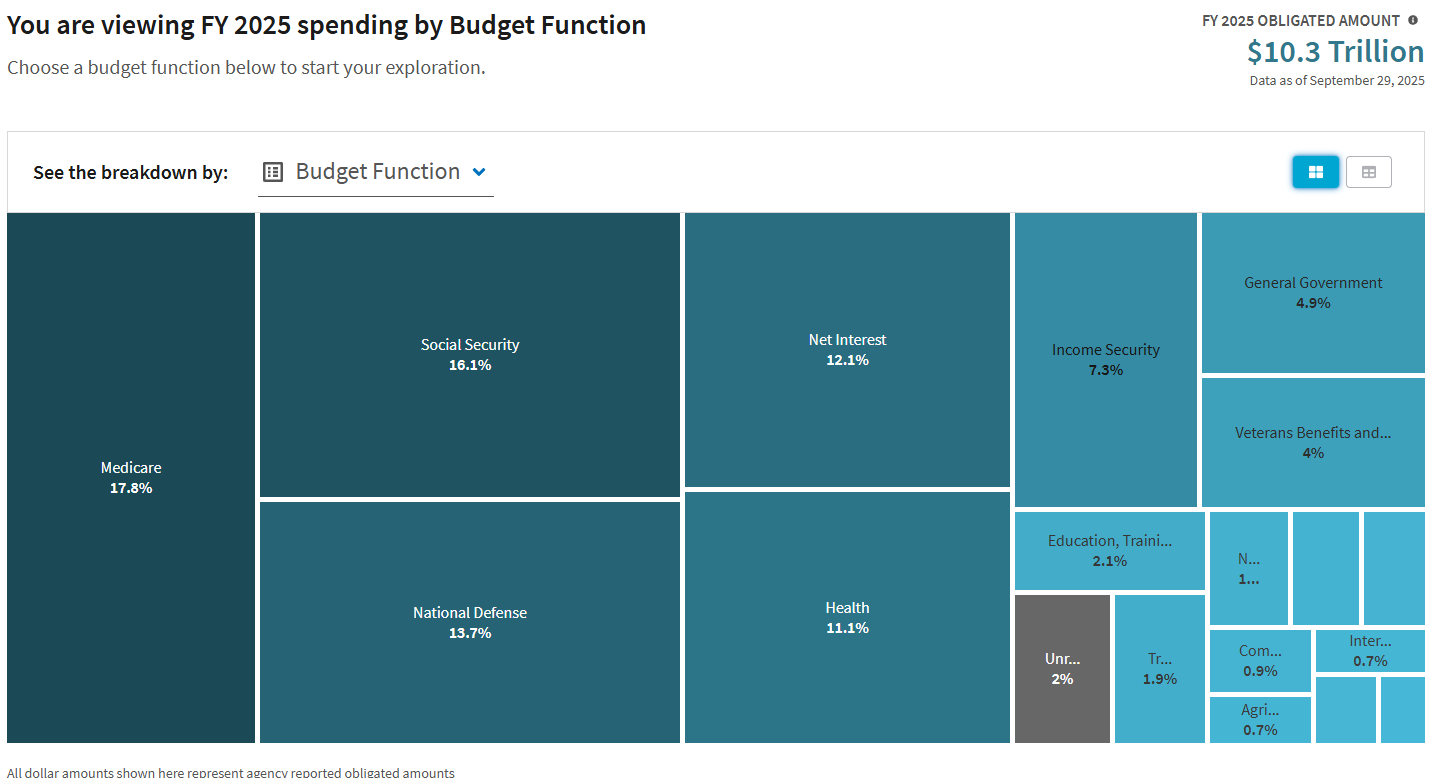

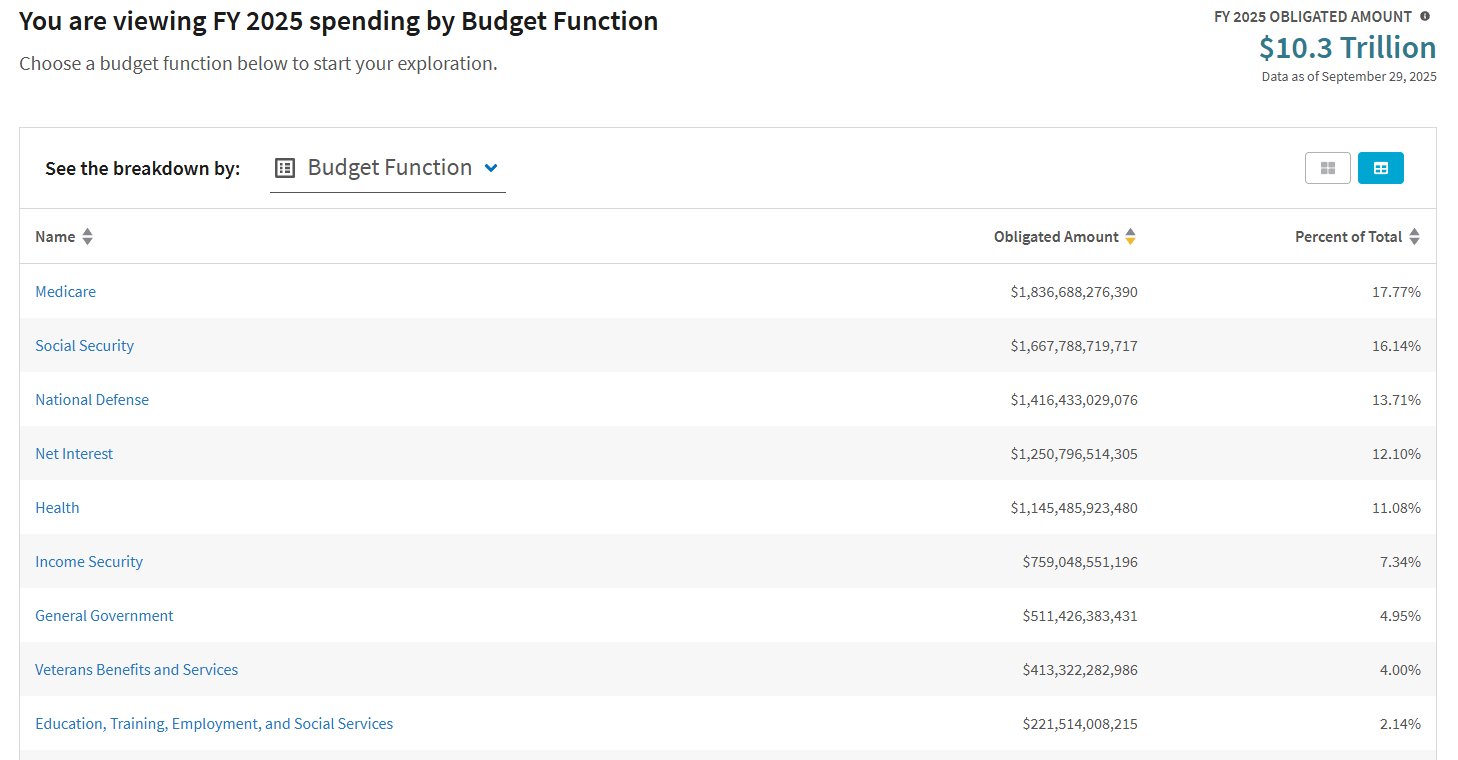

Question of the Day: What are the top three expenses the government paid for with our tax dollars in the most recent tax year?

It's important to first understand how much a common starting salary pays in taxes. But then where does it go?

Answer: Health (Health + Medicare) first at 28.9%, Social Security second at 16.1% and National Defense third at 13.7%

Questions:

- Are you surprised by the top 3 categories the Federal government spends taxpayer money on? Explain.

- How would you adjust the spending allocation across these categories (if at all)? Why?

- What top three items do you think the government will spend tax dollars on in ten years? Why?

Behind the numbers (USA Spending):

-----------------------

Taxes on the mind? Check out NGPF's Taxes blog which is full of ideas to engage your students!

-----------------------

Want to attend NGPF Professional Developments and earn Academy Credits on your own time? Check out NGPF On-Demand modules!

About the Author

Dave Martin

Dave joins NGPF with 15 years of teaching experience in math and computer science. After joining the New York City Teaching Fellows program and earning a Master's degree in Education from Pace University, his teaching career has taken him to New York, New Jersey and a summer in the north of Ghana. Dave firmly believes that financial literacy is vital to creating well-rounded students that are prepared for a complex and highly competitive world. During what free time two young daughters will allow, Dave enjoys video games, Dungeons & Dragons, cooking, gardening, and taking naps.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS