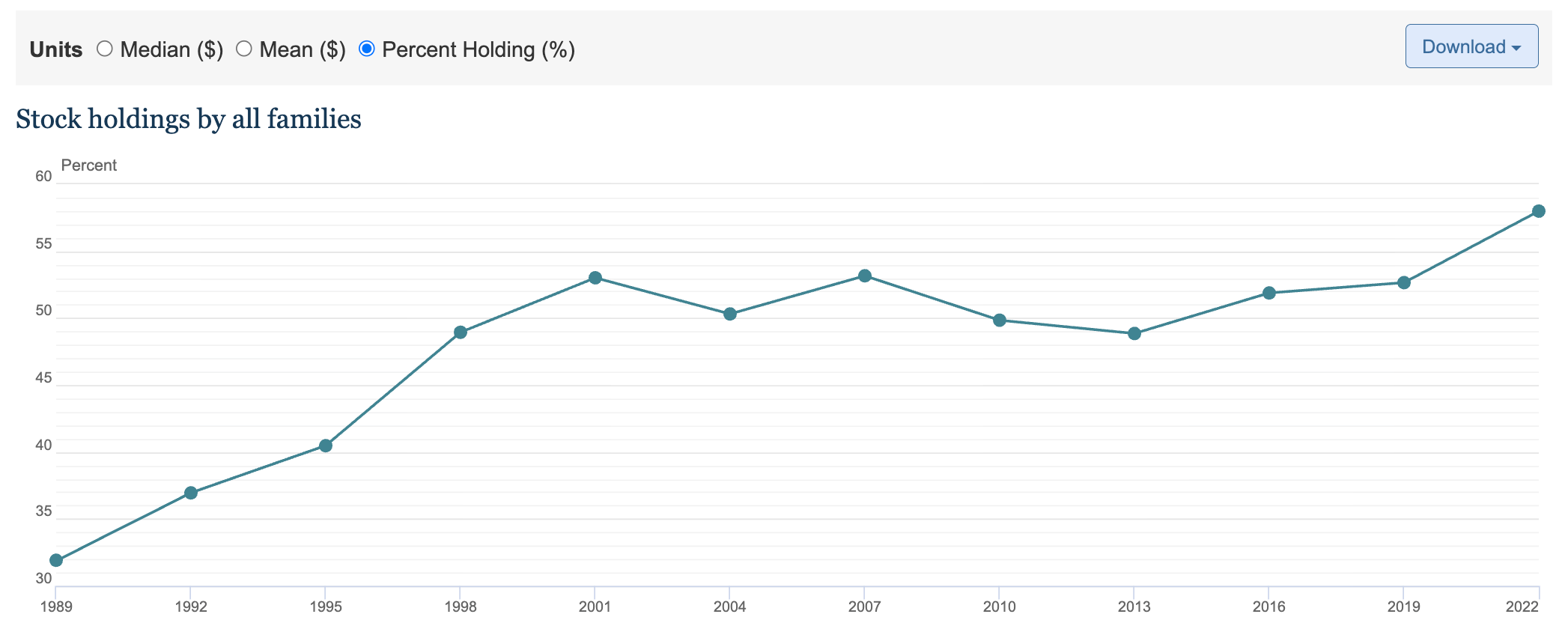

Question of the Day: What percent of American families invest in the stock market?

Take a guess - is it 27%, 45%, 58%, or 74%?

Answer: 58%

Questions:

- Write a title for the graph.

- This data is from a 2022 Federal Reserve survey. Do you think more families have invested since then?

- Only 21% of families own individual stocks. Why do you think that most investors choose funds (collections of stocks) rather than individual stocks?

Click here for the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the numbers (Federal Reserve)

From the Survey of Consumer Finances: "Participation in the stock market increased across the usual income distribution between 2019 and 2022, with families between the 50th and 90th percentiles experiencing a substantial increase. Amid a sizable rise in major stock indexes over this period, all major income groups experienced robust growth in the conditional median and mean values of their holdings.

---------------

Want to give your students an experience of what it feels like to invest in the stock market? Have them play NGPF's STAX Arcade game.

About the Author

Kathryn Dawson

Kathryn (she/her) is excited to join the NGPF team after 9 years of experience in education as a mentor, tutor, and special education teacher. She is a graduate of Cornell University with a degree in policy analysis and management and has a master's degree in education from Brooklyn College. Kathryn is looking forward to bringing her passion for accessibility and educational justice into curriculum design at NGPF. During her free time, Kathryn loves embarking on cooking projects, walking around her Seattle neighborhood with her dog, or lounging in a hammock with a book.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS