Question of the Day: How quickly do you need to report a stolen debit card to get all your money back?

Credit cards offer more protection from unauthorized charges. But what happens if you lose your debit card?

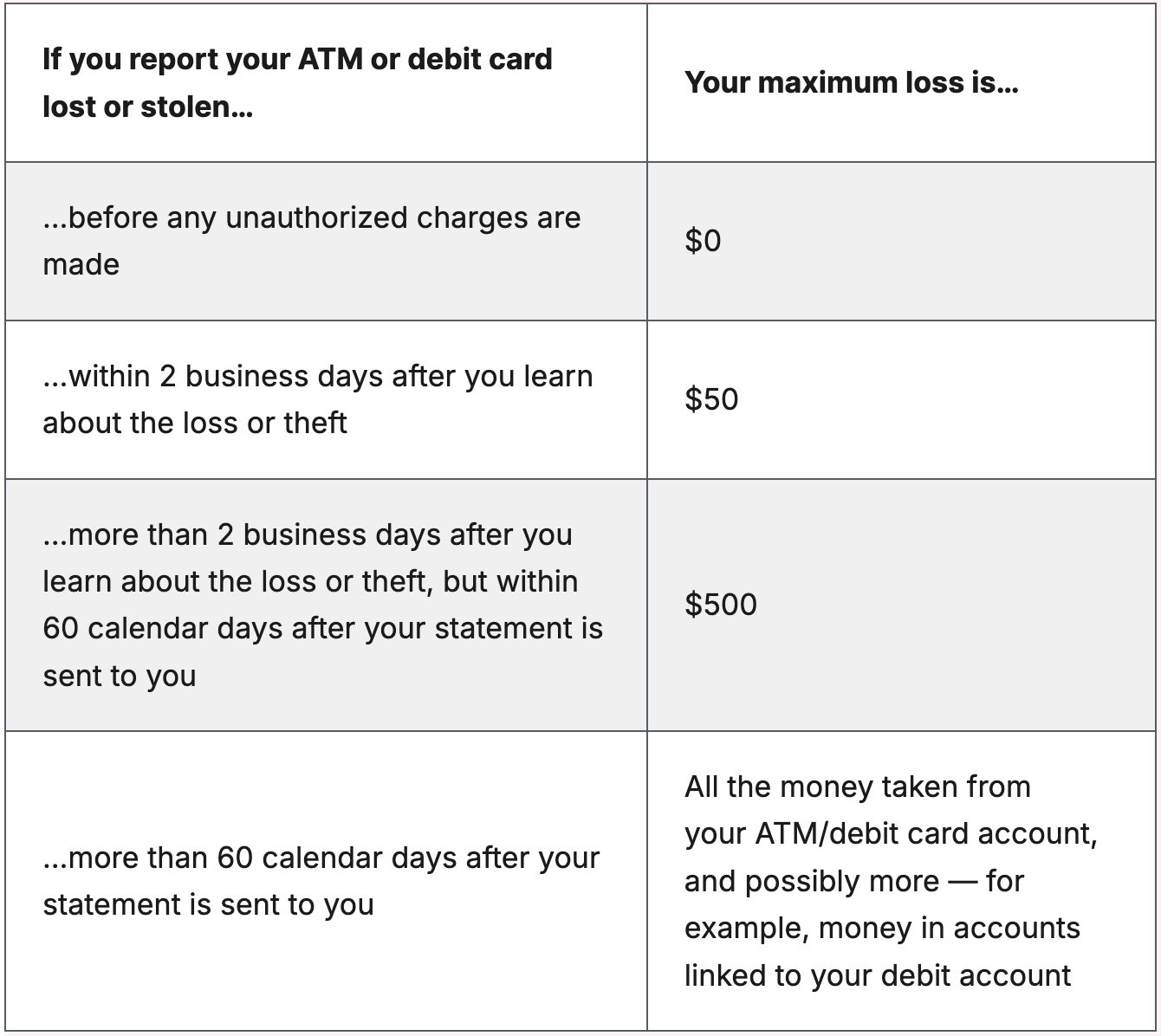

Answer: Before any unauthorized charges are made.

Questions:

- Do you know anyone who has had their debit card stolen? What happened?

- What steps can you take to protect yourself?

- If you report your card stolen after 5 days, what is the maximum amount of money you can lose?

Click here for the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the numbers (Federal Trade Commission):

"Under federal law, you have protections that help limit what you have to pay if your credit, ATM, or debit cards are lost or stolen. If someone uses your ATM or debit card before you report it lost or stolen, what you owe depends on how quickly you report it.

How To Protect Your Account Information

- Don’t share your account information. Don’t give your account number over the phone unless you made the call — and know why you need to share it. Never leave your account information out in the open.

- Protect your accounts by using multi-factor authentication, when available. Some accounts offer extra security by requiring two or more credentials to log into your account. This is called multi-factor authentication — a security practice that makes it harder for scammers to log in to your accounts if they get your username and password. To log in to your account, you’d need either:

- Something you have — like a passcode you get via text message or an authentication app.

- Something you are — like a scan of your fingerprint, your retina, or your face.

- Keep an eye on your accounts. Regularly check your account activity, especially if you bank online.

- Carefully check your ATM or debit card transactions because they take money from your account right away. Report any withdrawals you don’t recognize to your bank or credit union immediately.

- For your credit cards, open your monthly statements promptly. Compare the current balance and charges on your account with your receipts. Report any charges you don’t recognize as soon as you discover them.

- Keep your cards, PINs, receipts, and deposit slips safe — and dispose of them carefully.

- Carry only the cards you'll need. Don't carry the PIN for your ATM or debit card in your wallet, purse, or pocket. Never write your PIN on the card itself, or on any piece of paper that you could lose or someone could see.

- Cut up old cards. Be sure to cut through the account number, the magnetic strip on the back, and the security code — before you throw the pieces away in separate bags. If your card has a chip, it may be difficult to cut. You may want to destroy the chip by smashing it into pieces with a hammer."

About the Author

Kathryn Dawson

Kathryn (she/her) is excited to join the NGPF team after 9 years of experience in education as a mentor, tutor, and special education teacher. She is a graduate of Cornell University with a degree in policy analysis and management and has a master's degree in education from Brooklyn College. Kathryn is looking forward to bringing her passion for accessibility and educational justice into curriculum design at NGPF. During her free time, Kathryn loves embarking on cooking projects, walking around her Seattle neighborhood with her dog, or lounging in a hammock with a book.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS