Question of the Day: If a single person taking the standard deduction makes $40,000, how much will they pay in federal income taxes?

If you earned $40,000 in 2025, how much will you pay in federal income taxes?

Answer: $2,671.50

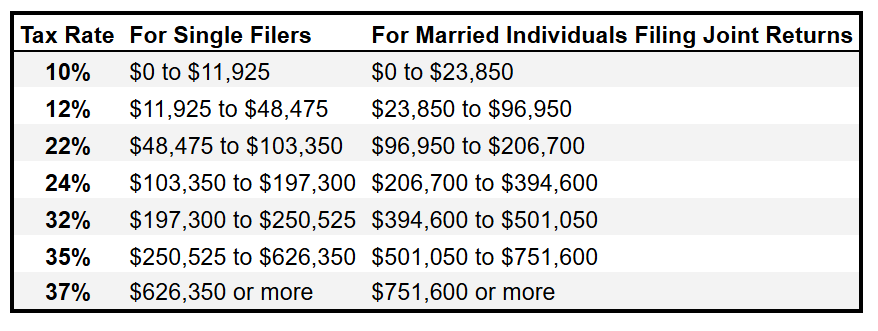

Total taxable income: $40,000 - $15,750 (standard deduction) = $24,250

10% of the first $11,925 = $1,192.50

12% of the remaining $13,075 = $1,479

Total federal income taxes: $1,192.50 + $1,479 = $2,671.50

Questions:

- What was your reaction to the answer? Why?

- What is the standard deduction, and why might someone choose it over itemizing deductions?

- Compare the tax situation of someone making $40,000 to someone making $80,000. How does the tax system address different income levels?

Here are the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the numbers (Nerdwallet):

"Contrary to popular belief, your income isn’t usually taxed at one single rate. Instead, parts of your earnings can fall into different brackets, which means you can end up paying several tax rates on different pieces of your income. How much you pay also depends on your income and your filing status (whether you're single, married, etc.)."

"The U.S. has a progressive tax system, which means that people with higher incomes are subject to higher federal tax rates, and people with lower incomes are subject to lower income tax rates.

The government decides how much tax you owe by dividing your taxable income into chunks — also known as tax brackets — and each individual chunk gets taxed at a corresponding tax rate. Tax rates can range from 10% to 37%.

The beauty of tax brackets is that no matter which bracket(s) you’re in, you generally won’t pay that tax rate on your entire income. The highest tax rate you pay applies to only a portion of your income."

------------------

Explore how the government spends tax money in MOVE: Your Tax Dollar In Action.

About the Author

Dave Martin

Dave joins NGPF with 15 years of teaching experience in math and computer science. After joining the New York City Teaching Fellows program and earning a Master's degree in Education from Pace University, his teaching career has taken him to New York, New Jersey and a summer in the north of Ghana. Dave firmly believes that financial literacy is vital to creating well-rounded students that are prepared for a complex and highly competitive world. During what free time two young daughters will allow, Dave enjoys video games, Dungeons & Dragons, cooking, gardening, and taking naps.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS