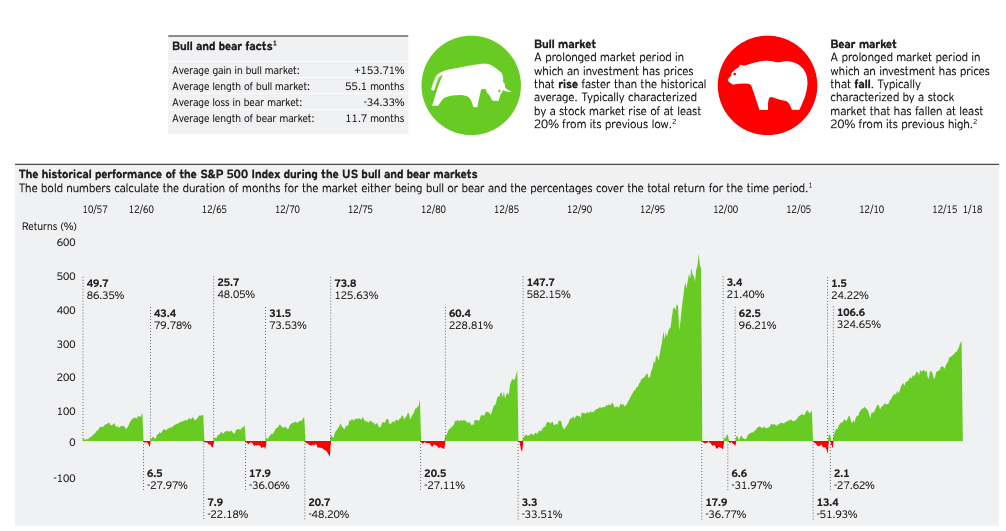

Question of the Day: How many bear markets (stock market declines of 20% off the peak) have there been in the past 63 years?

Answer: 10+1 or about once every 6 years.

- It was 10 until yesterday when the S&P 500 index was more than 20% below its previous high.

Note: The number in bold is the duration (in months) of the bull/bear market. The %age is the rise or decline in stocks over that period. Bull in green and bear in red.

Note: The number in bold is the duration (in months) of the bull/bear market. The %age is the rise or decline in stocks over that period. Bull in green and bear in red.

Questions

- What time period had the best performing bull market? the worst bear market?

- How do bull and bear markets compare when it comes to their duration and the change in stock prices?

- Which tend to have longer durations?

- Which tend to have a greater impact on stock prices?

- Your friend who just started investing and says "I better get out of the market because I think that prices are going to keep going down for a very long time." Using evidence from the chart, agree or disagree with his desire to sell his stock. Focus on the typical length of a bear market in your answer.

- Do investors who hold their stocks through bear markets typically make their money back in bull markets?

- For example, if you owned $100 in stock in the bear market of 1960, the value would have declined 27.97% so you would have about $72.

- The bull market that came next saw your $72 in stock increase by 79.78% so you would have had $129

- Profit = $72 * .7978 = $57

- Value at beginning of bull market = $72

- Total =$129

- Since $129 is greater than your investment at the beginning of the bear market of $100, you would have made money by holding through the bear AND bull market from 1960-1965.

Lots more great math problems here with percentages as you could complete this same calculation for every one of the 10 bull and bear market pairs listed above.

Behind the numbers (CNN; 3/10/20):

The Dow and S&P 500 both fell more than 20% from their recent highs Wednesday in light of coronavirus fears..The S&P 500 was last in a bear market in late 2007, 2008 and early 2009 -- during the height of the Great Recession and Global Financial Crisis. The index fell more than 56% from its peak before bottoming out.

--------------------------

Look for Jonathan Clements on the NGPF Podcast this Friday where he helps us make sense of the recent volatility in the markets and what it means for investors.

--------------------------

Want an explainer video for bull and bear investing markets? Check out this FinCap Friday: The Raging Bull.

About the Author

Tim Ranzetta

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS