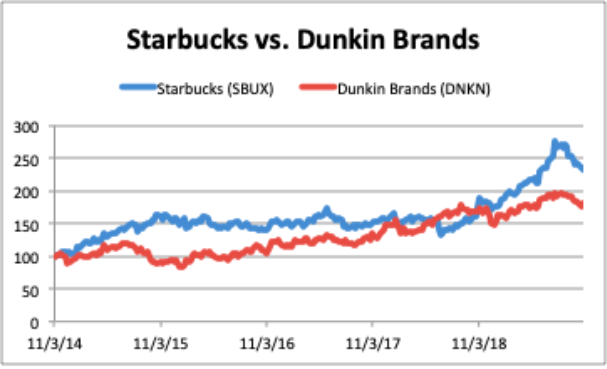

QoD: Starbucks vs. Dunkin Donuts: Which company's stock has performed better over the past five years?

People tend to be pretty vocal about their preferred "go-to" coffee spots. Who is winning the coffee war (from the investor's perspective)?

Answer: Starbucks.

Questions:

- What factors do you think contribute to the very different market performance of these companies?

- Starbucks is much larger and has a larger international presence. Do you think those factors are important?

- Which do you personally prefer? Explain why you prefer it.

- Would you make an investment decision based on a personal preference?

- Dunkin Donuts briefly outperformed Starbucks in 2018 when Dunkin Donuts was growing its customer base and stores, while Starbucks was having issues with customers and employees. How much do you think customer attitude and employee satisfaction influence the stock price?

Here's the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the numbers:

Investopedia does a good job of explaining the similarities and differences of these two companies, which happen to be the two largest chains of coffee-based food outlets.

- Dunkin Donuts had a 20-year head start, but Starbucks has grown to have revenue 18 times that of Starbucks in fiscal 2018.

- Dunkin Donuts has over 20,500 locations worldwide, compared to Starbucks’ more than 28,000, but Starbucks gets a larger proportion of its revenue from overseas.

- Dunkin Donuts business model is the franchise, (with many outlets combined with Baskin Robbins ice cream.) Most Starbucks are company owned stores; the rest are licensed outlets. Bottom line is the cost structure of each is different.

- Both companies work hard to pull customers in after breakfast. Starbucks is trying to provide a more “premium” coffee house experience, where one can hang out at any time of day. While Dunkin’s donuts are a huge draw, it has a harder time drawing folks in all day.

**Want to try this at home? You can do it for any stocks!

- Pull historical stock information from Yahoo Finance for 5 years for each company and drop in Google sheet.

- Using the Adj. Close column (which accounts for dividends), index the first day in the series to 100. How? Divide each of the adj. stock prices by that first day’s stock price.

- Then arrange three columns with one being date, second being first company’s stock prices indexed to first day in the series and the third for the other company’s indexed stock prices.

- Highlight those three fields, and Insert>Chart and voila you have the stock comparison chart you see above.

--------------------

For similar comparisons, try these stock match-ups: Nike vs. Under Armour, AT&T vs. Verizon, and Coke vs. Pepsi.

See if your students stock-picking prowess can beat the computer in the investing game STAX.

--------------------

For Starbucks fans out there, here's the most complete set of statistics that I have ever seen about the company!

About the Author

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS