Time for Some Levity: Cartoons About Credit Cards

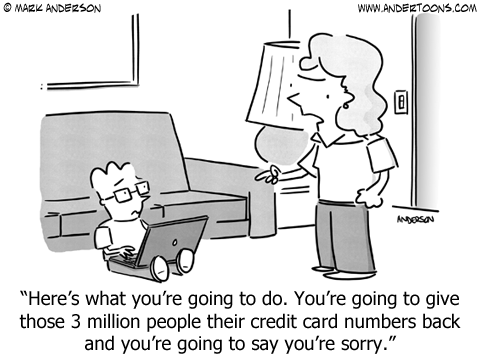

Questions:

- What is the main point of the cartoon?

- How can a person protect themselves if their credit card number is stolen?

- Are consumers responsible for charges made on their cards that they didn't authorize?

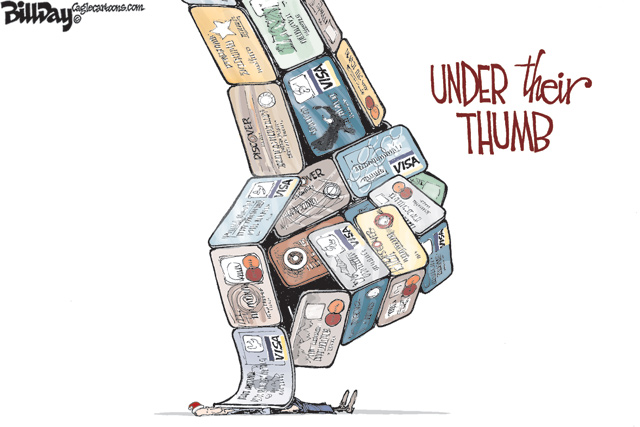

Questions:

- What point is the cartoonist making?

- Who is the person "under the thumb?" Who is holding them down?

- What are the ways that credit cards can do this to consumers?

- What are ways that consumers can avoid being "under the thumb" of card companies?

Questions:

- What is the point of this cartoon?

- Do credit card companies require you to pay off the full balance every month?

- If you don't pay off the balance in full every month, what are the consequences?

- How quickly do credit card companies hope that you will pay your bill?

Questions:

- What does the cartoonist mean when he says "something costs too much and you want to pay more for it?"

- How do consumers pay more for something that they use a credit card for?

- Have you ever seen a store that offered a discount if you paid with cash? Why do you think they do that?

- Are there situations where a credit card company pays you for purchases you make? Give examples?

-------

Looking for more cartoons on different personal finance topics? We have more at the NGPF Blog!

About the Author

Tim Ranzetta

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS